The Total Visa® Unsecured Credit Card reports to all three credit reporting agencies - Experian, Equifax, and TransUnion.

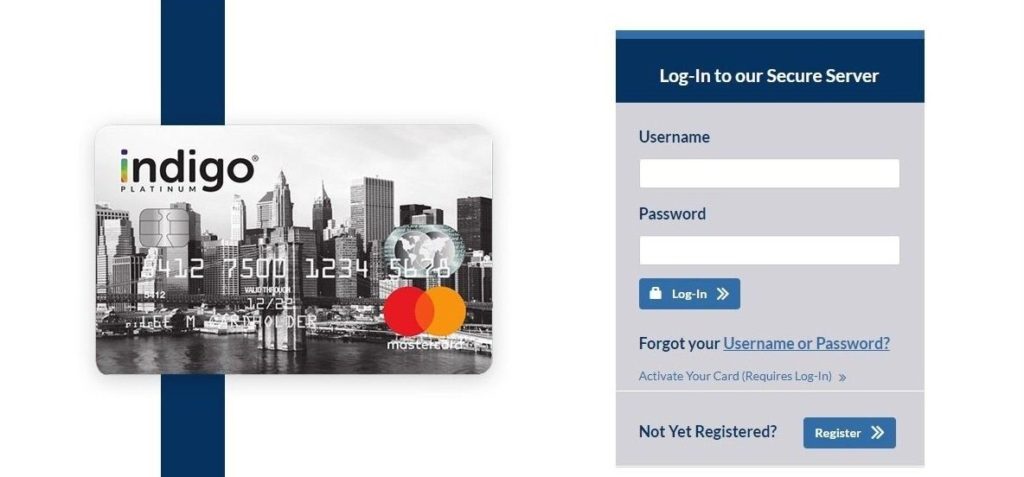

Also remember that, once your build your credit up, you can apply for a different card with lower fees and better perks. Consider this card if you’re ready to build your credit and can’t get approved elsewhere. While the Total Visa® Unsecured Credit Card does charge fees some competing cards don’t. Charge only what you can afford to repay each month to avoid paying this card’s hefty interest rate on your purchases.Pay the program fee to start using your card.Fill out the online application and receive a response in as little as a minute.Keep in mind that rebuilding credit depends on factors like making on-time payments, keeping balance below credit limit and paying at least the minimum monthly payment. Consider the Total Visa® Unsecured Credit Card if you’re ready to prove your creditworthiness and rebuild your credit over time. Additionally, it’s backed by Mastercard®, meaning you’ll be able to use it just about anywhere.īecause the Total Visa® Unsecured Credit Card is geared to consumers with poor credit, this is a smart option to consider if you’ve made credit mistakes in the past but want a card that’s unsecured. The Milestone® Gold Mastercard® offers a lot of great features to anyone with bad or fair credit - more forgiving guidelines on a previous bankruptcy, lower upfront costs and transaction fees during the first year, and no security deposit required. After your credit score improves, make the switch to a card with a rewards program.ĭepending on your credit profile, there may be some upfront fees associated with opening your account.Budget to pay off your balance monthly (or twice a month!) to build credit and avoid the higher penalty APR.Take advantage of pre-qualification to check your eligibility without a hard inquiry on your credit score.Milestone also offers a pre-qualification option to let you know the likelihood of getting approved without impacting your credit score. While the card does have an annual fee and possible account opening fee associated with it, it offers some other perks. The Milestone® Gold Mastercard® is another card that’s forgiving of a previous bankruptcy and won’t necessarily disqualify you if there’s one on your credit report. As a cardholder, you’ll benefit from no security deposit and a small annual fee as you work toward improving your credit score. The forgiving guidelines with the Indigo® Platinum Mastercard® make it a desirable option for anyone who’s felt limited by a previous bankruptcy on their credit report.

INDIGO MASTERCARD FOR LESS THAN PERFECT CREDIT FULL

To avoid paying more in interest and fees, be sure to pay your balance off in full and on time each month. Once your credit score is where it needs to be, consider switching to a card that offers a rewards program.Pay your balance on time each month to strengthen your credit score and avoid the high penalty APR.Answer a few pre-qualification questions to find out if you’re likely to be approved.They offer a pre-qualification option to let you know your likelihood of getting approved (without a hard credit inquiry that could lower your score). If you’re still not sure if you’ll qualify, don’t worry. Luckily, this card’s relaxed guidelines won’t necessarily disqualify you for a previous bankruptcy. A bankruptcy can stay on your credit report for seven to 10 years, making it difficult to move past it and rebuild your credit. Anyone who has previously filed for bankruptcy should consider the Indigo® Platinum Mastercard®.

0 kommentar(er)

0 kommentar(er)